Non-Consensus Views: The GMI Top 5 Charts That Make You Go Hmmm...

In this special edition of our weekly newsletter, we’re going to outline our more upbeat view on 2023, which remains widely non-consensus and has been our core view since October of last year – see Raoul’s Tweet thread on “October the Bear Market Killer”. We have attached below the link to the tweet thread:

As ever, much fuller and more in-depth analysis can be found in Global Macro Investor and Real Vision Pro Macro. Global Macro Investor is our full institutional research service and Real Vision Pro Macro is the sophisticated retail investor service, which is co-authored with leading research firm MI2 Partners.

Let’s dive right in...

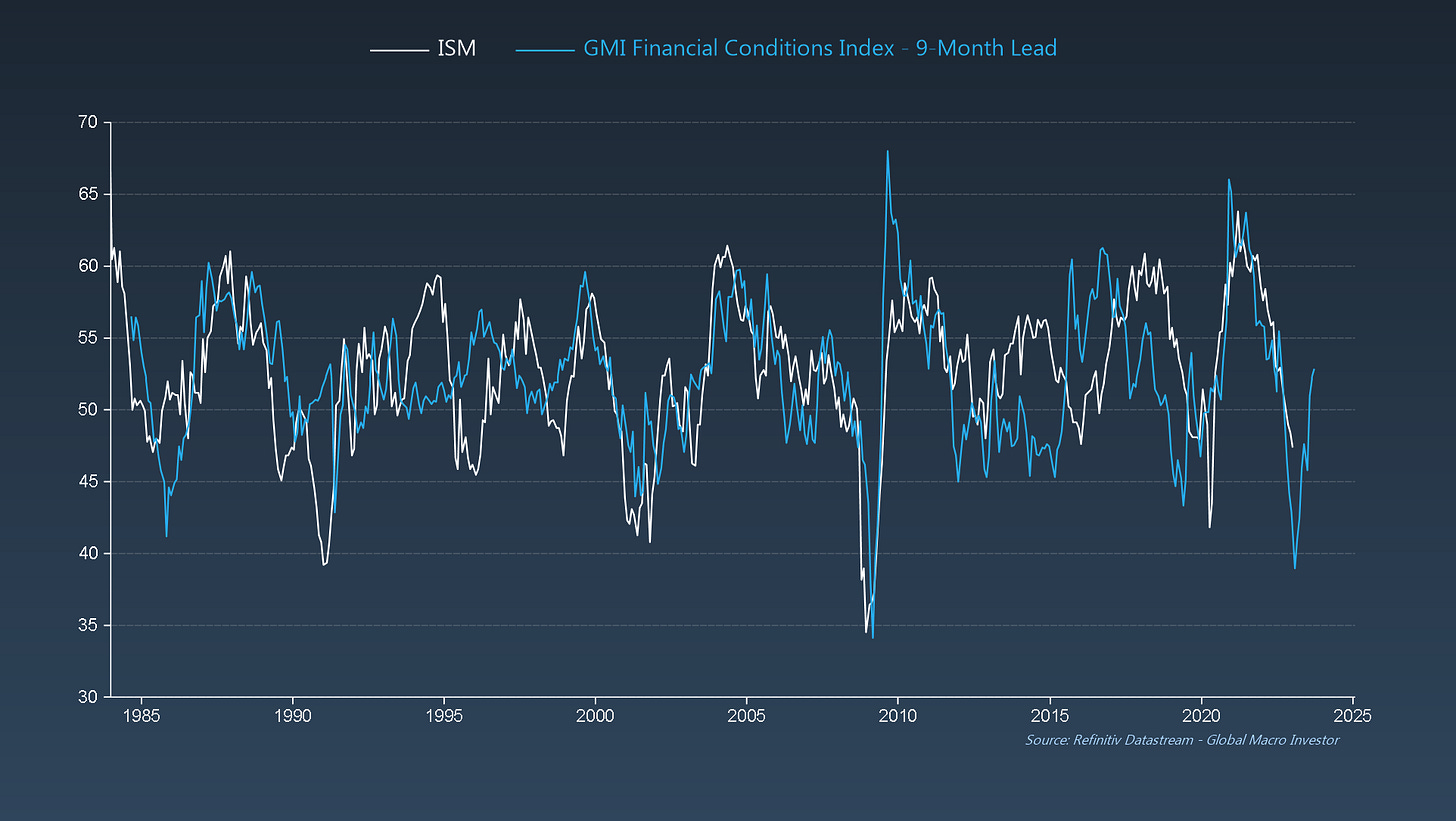

GMI Chart 1 – ISM vs. GMI Financial Conditions Index (May 2022 GMI Round Table Snapshot)

For those GMI clients who attended the GMI Round Table in Grand Cayman last year and/or read the full May 2022 GMI report “Demand Destruction”, this is exactly the chart that you would have seen.

At the time, our GMI Financial Conditions Index – a regression on the dollar, interest rates and commodity prices – was forecasting significant economic weakness ahead with the ISM still above 55.

After reviewing this chart during the Round Table last May with many of our clients (as well as many other of our lead indicators) the key takeaway from the session was that growth was about to collapse due to a near-unprecedented tightening in financial conditions effecting widespread demand destruction.

How did we do on this call?

GMI Chart 2 – The Conference Board Leading Economic Index YoY%

Well today, the Conference Board Leading Economic Index has plunged to 100% recession territory...

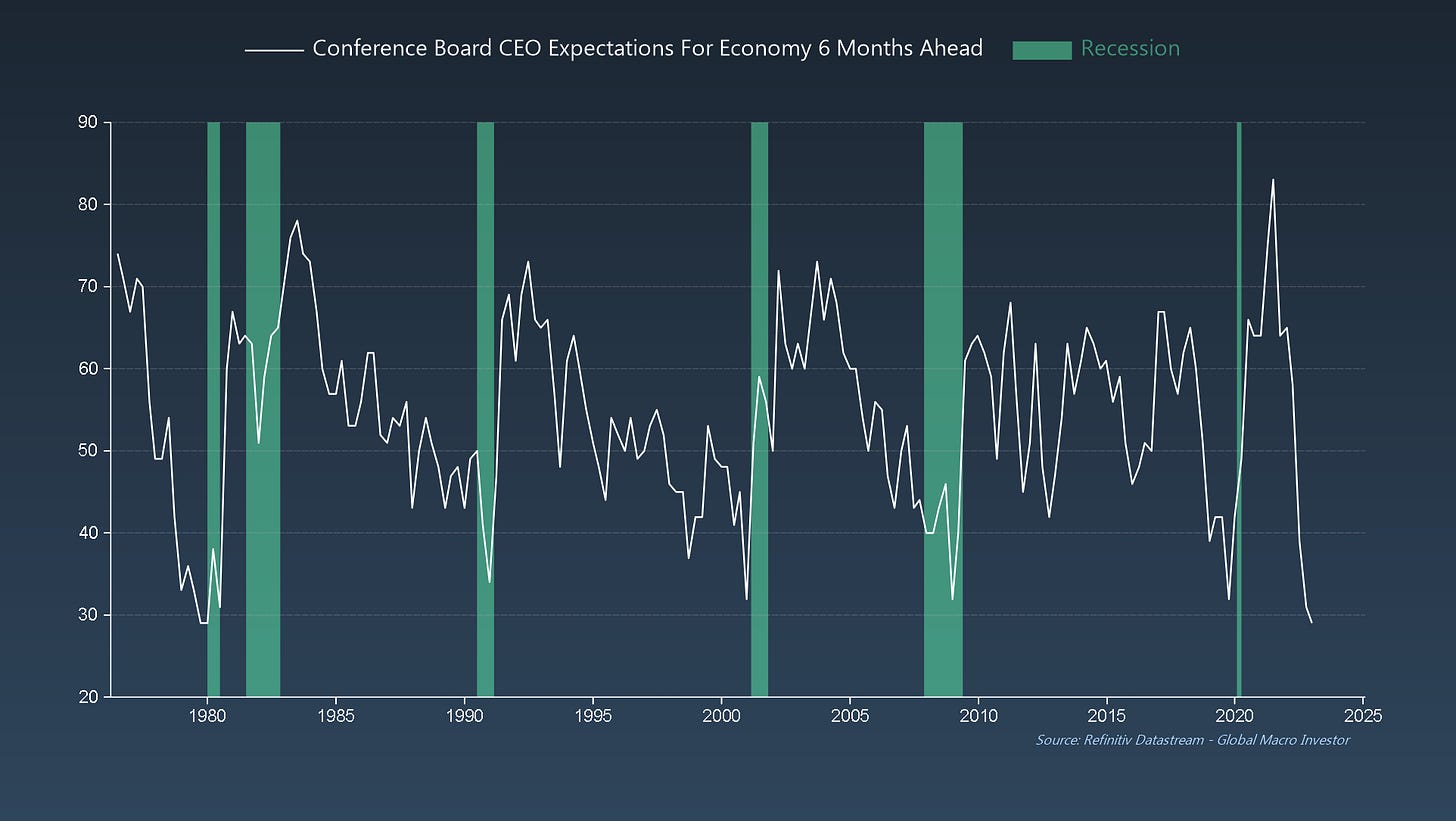

... CEO Expectations have collapsed to their lowest levels since 1979...

... and consumer sentiment fell to a record low in June of last year – going back to 1950...

So, growth did indeed collapse...

And, if the previous three charts don’t settle the recession debate, we think the following chart does...

Of the eighteen industries covered in the ISM Manufacturing Survey, zero reported any growth in December – the lowest since the Global Financial Crisis...

Recession is knocking. No, it’s not yet evident in coincident (industrial production) and lagging economic data (unemployment) because surveys tend to be leading, but a recession is coming...

GMI Chart 3 – Philadelphia Fed Survey of Professional Forecasters: Probability of Recession

On the other hand, literally EVERYONE is now expecting a recession – officially the most forecasted recession on record!

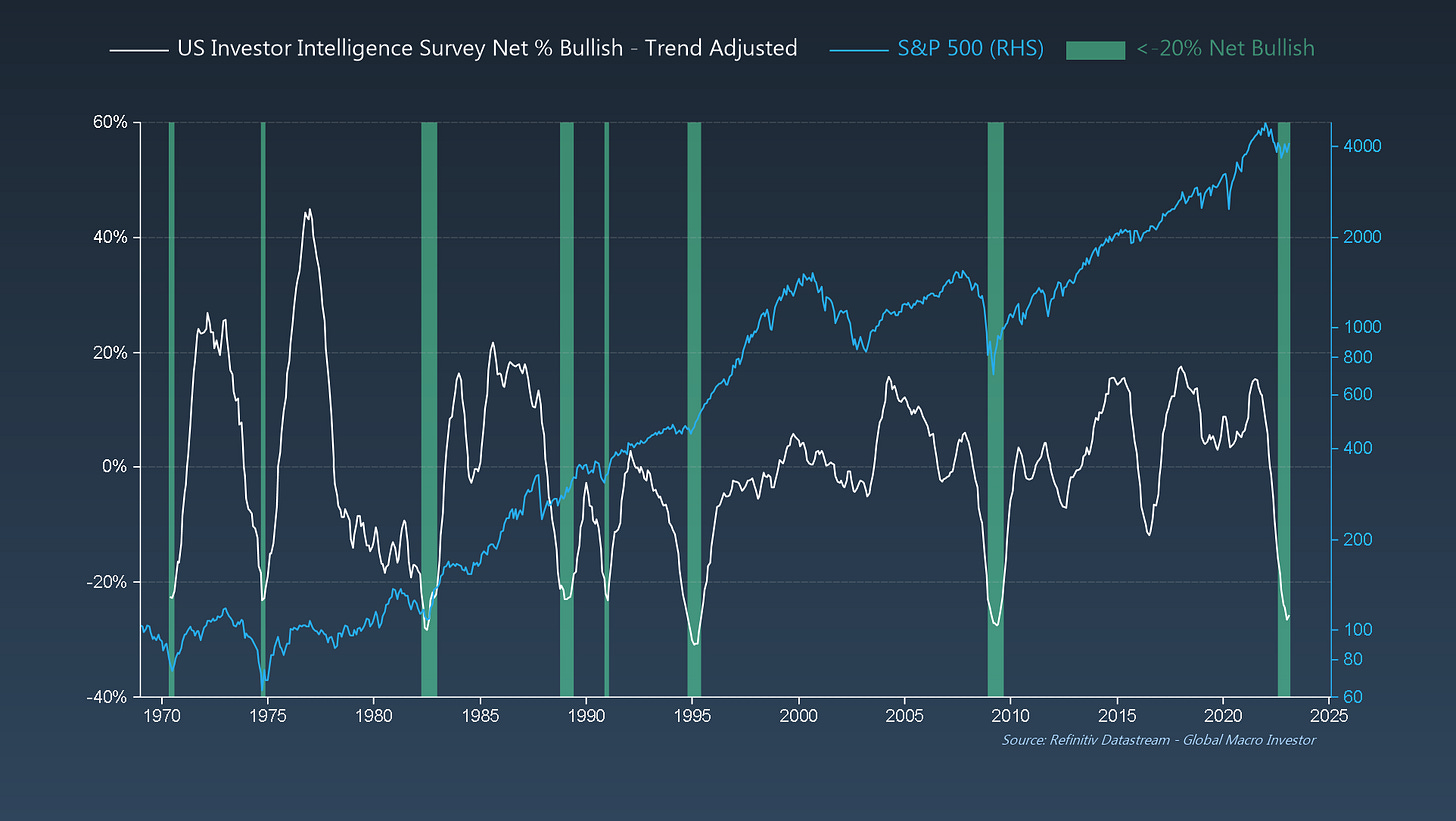

... sentiment is EXTREMELY depressed...

... and everyone is still short equities...

The question we now need to ask ourselves as investors is: if everyone is in the recession camp, then where is the negative surprise going to come from?

GMI Chart 4 – Bloomberg Commodity Spot Index YoY% vs. US CPI YoY%

Is inflation the 2023 boogie monster? No...

As we’ve been highlighting for quite some time, this is not what inflation looks like. Commodity prices have come down considerably from the highs of June last year and currently have CPI below 2%...

... and ISM price internals forecast CPI briefly negative by 2024 – increasingly our base case...

GMI Chart 5 – ISM vs. GMI US Regional Manufacturing Survey Composite

Is growth the 2023 boogie monster? No...

This week the January ISM data showed the ISM fell to 47.4 versus consensus estimates for 48.0 – our lead indicators had been warning of a negative surprise...

However, it is our job as macro investors to try and live six to eight months in the future, and the future looks altogether better according to our GMI Financial Conditions Index (the chart included at the beginning but here updated) and is now suggesting that the ISM should find a bottom later in Q1 or early Q2...

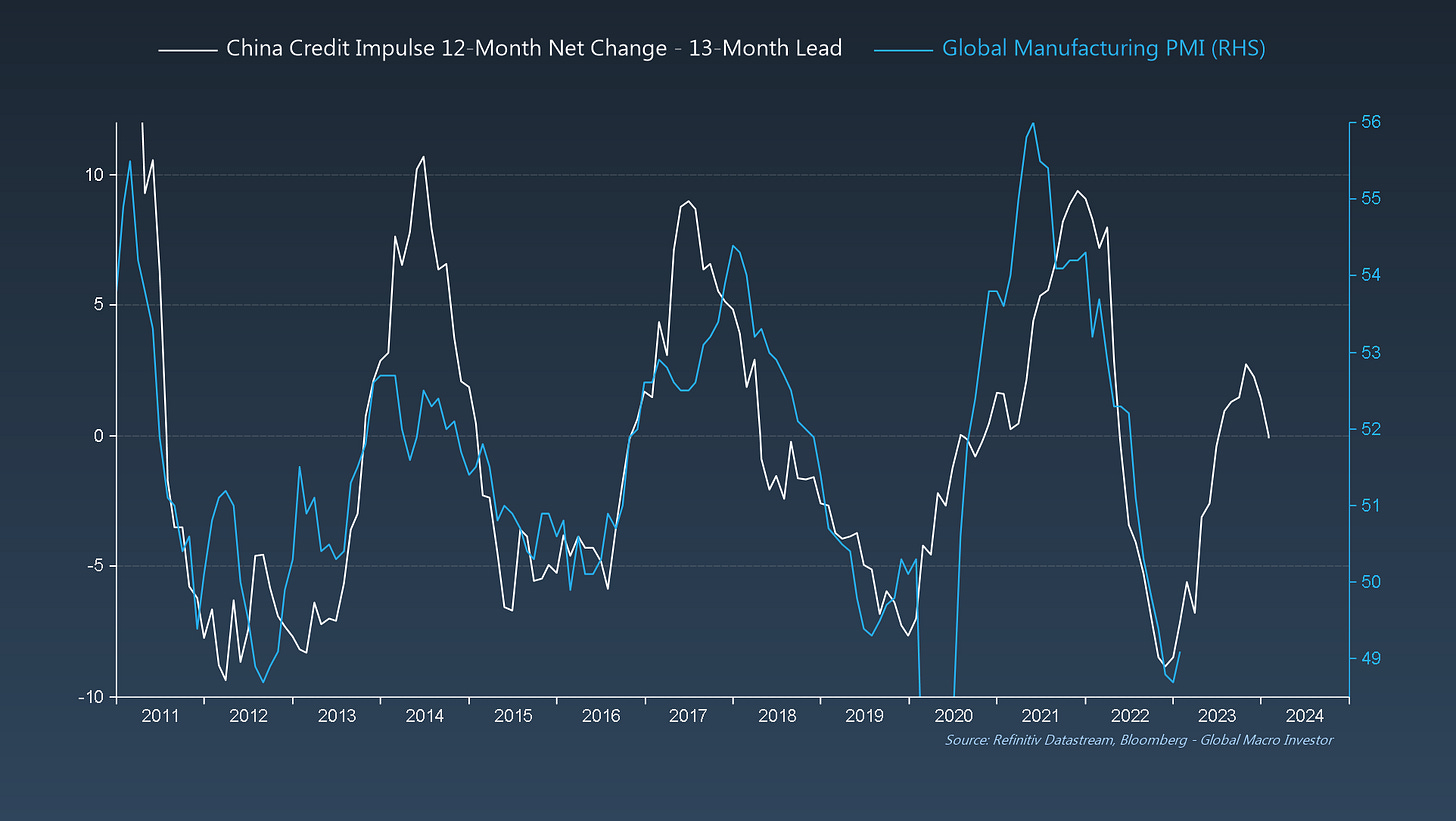

It’s the same when looking at the Global Manufacturing PMI vs. the China Credit Impulse...

The GMI Big Picture

As recession comes into view, central banks change their policies to support the economy.

The Global Manufacturing PMI (shown inverted here and advanced seventeen months) is forecasting significant economic weakness ahead, and thus liquidity is on the cusp of turning higher to offset the fall in economic momentum...

And at the end of the day, the business cycle drives the liquidity cycle, and the liquidity cycle is on the verge of a major inflection point that we expect has bottomed and should now start to accelerate.

Remember, since 2008 nearly 100% of the variability in equity prices has been explained by changes in global liquidity conditions...

We’ve been very vocal on our more constructive stance for equities in early 2023 and, so far, the S&P 500 is up 10% (17% since we called the lows in October) and the NDX alone is up 20% year-to-date.

A final note (warning: contrarian take); this doesn’t need to be 2008. A lot of investors are suffering from recency bias and think that we need to complete a peak-to-trough 50% decline in equities to price in a recession, but that’s just not true.

As previously mentioned, in our opinion, the big macro imbalances necessary to trigger a repeat of the GFC just aren’t there. We think this looks a lot more like the 1990s recession: bad, but nothing systemic or entrenched as in 2000 and 2008. This recession is a result of soaring real yields and an unprecedented tightening of financial conditions, both of which can be easily remedied with rate cuts plus QE.

Investors also seem to be overlooking the fact that the NDX in October was already down 38% from the peak – not a small move – and bar a major financial crisis (not our base case), consistent with recession being fully in the price.

The NDX has already priced in an ISM of 37.7 – exactly what our GMI Financial Conditions Index was forecasting in May of last year, but has since inflected higher as shown previously...

So, we think this is what equities are starting to sniff out – an easing in financial conditions, driven partially by a less hawkish Fed (which we’ve been expecting), but more generally an improvement in overall liquidity conditions.

Liquidity is king and when liquidity changes, everything changes...

Good luck out there and please subscribe for regular updates from us.

Enjoy!

Raoul Pal – CEO, Founder - Global Macro Investor

Julien Bittel – Head of Macro Research - Global Macro Investor

I absolutely love these short gmi versions. Thank you. For a normie like me to have information like that is just incredible. Gives me so much confident in understanding the current macro environment

Yes, it is amazing that now the small guy has this leading edge information that all the big investors previously, always had access to !

Thank you Raoul.