When it comes to understanding how the economy works, nothing comes even close to the business cycle. Our work here at GMI is rooted in it and for good reason. Want to understand where Fed liquidity is headed?Business cycle. How about Global M2? Business cycle! It’s a roadmap that once understood properly, completely changes the way you think about markets and investing.

In this edition of the newsletter, I’m going to walk you through where we are in the business cycle in fifteen charts. Let’s go!

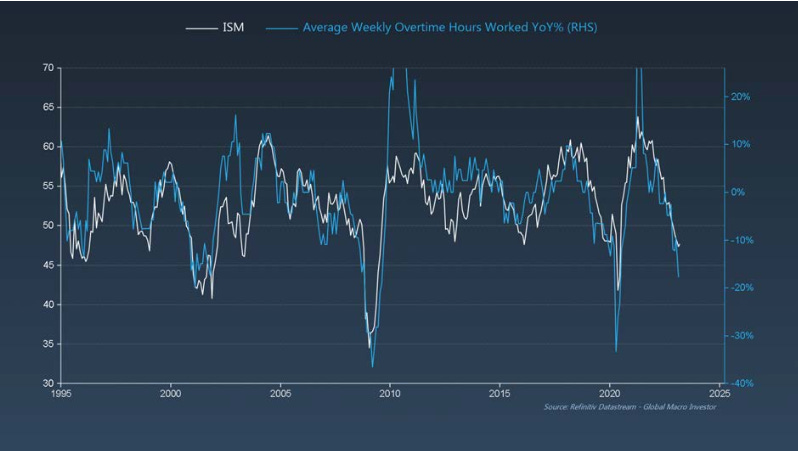

Weekly Overtime Hours Worked plummeted in February and is pricing ISM at below 45…

Philly Fed data is painting a similar, yet slightly bleaker, picture with the ISM closer to 40…

The same applies to CEO Confidence. It’s important to note that it has already bottomed for the cycle…

As we’ve been saying for a while, the key thing to note here is that even if ISM collapses to 40, we think it is largely already baked into the price…

Recent dollar weakness, falling commodity prices and lower bond yields have caused our GMI Financial Conditions Index to really start moving higher – a tailwind for growth momentum…

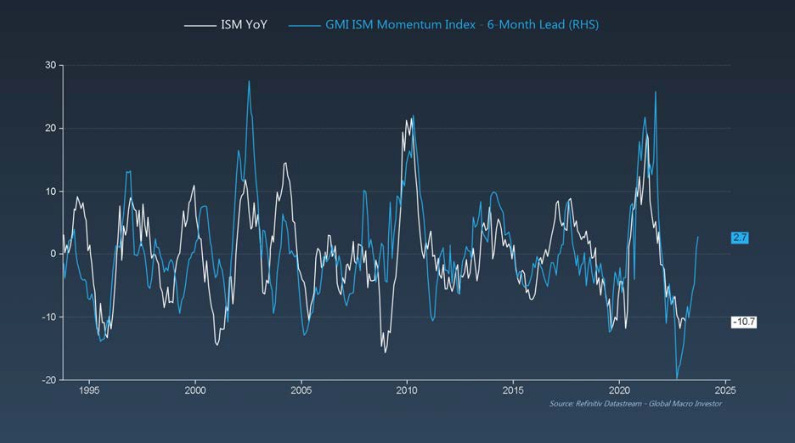

Interestingly enough, one of our ISM YoY leads is currently suggesting that the ISM could jump 2.7 points by September. What does this mean? ISM at 53.7! Expansion…

Ok, let’s talk about inflation…

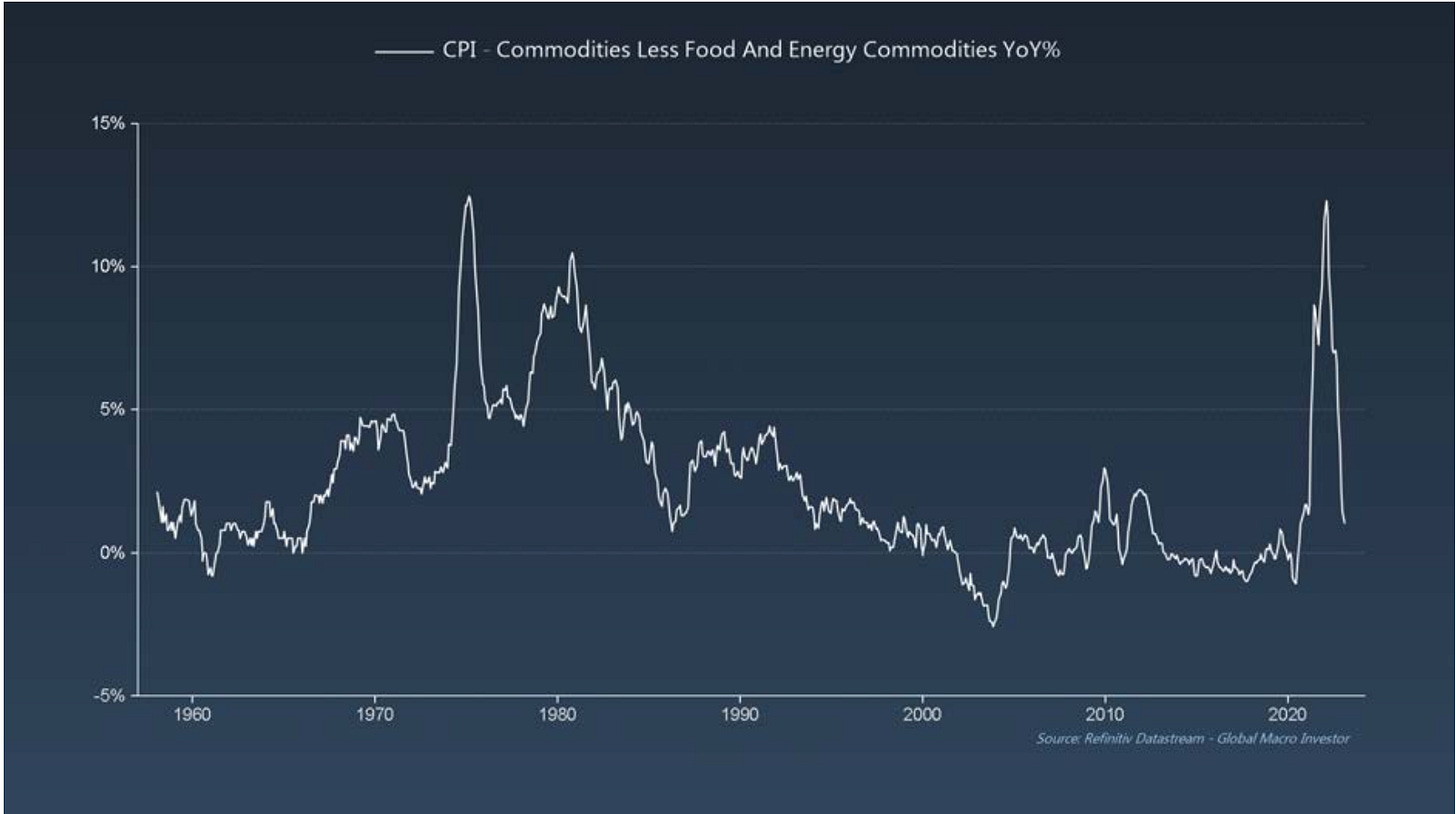

Commodity inflation collapsed and has now turned negative year-on-year. CPI is about to free fall…

Lower commodity prices result in lower goods inflation. Elevator up = elevator down!!

Want to know why CPI remains elevated for the time being? CPI: Shelter represents 34% of total CPI and approximately 60% of CPI: Services. Shelter is ALWAYS the last shoe to drop…

As we’ve been discussing for months now, house prices inflation will soon go briefly negative…

Have a look at Wage pressure… peaked!

Now take a look at inventories… still WAY too high and making itself known in no uncertain terms in the NFIB Small Business Report…

Supply chain pressures also continue to ease – as we keep saying – CPI is going to collapse from here!

Rounding out the last two charts are semiconductors. The semiconductor cycle is about to bottom and will likely turn higher from here. Naturally, China is the main driver in this space and leads Semiconductor Sales Year-on-Year by 12 months…

In relative terms, SMH vs the SPX has already begun to figure this out. SMH/SPY has been leading the ISM for years now and has already discounted an ISM of about 44. However, it’s been rocketing and currently seems to be pricing the ISM at 52.5 nine months from now. Many of our lead indicators are suggesting the same and still have some room to run…

There you have it – the business cycle in fifteen charts! Conclusion? CPI is about to go into free fall – ISM will head much lower before reversing course and going back into expansionary territory. I’ll leave you with this tweet from the other day…

As ever, much fuller and more in-depth analysis can be found in Global Macro Investor and Real Vision Pro Macro. Global Macro Investor is our full institutional research service and Real Vision Pro Macro is the sophisticated retail investor service, which is co-authored with leading research firm MI2 Partners.

We’ll be back next week with our Top 5 GMI Charts update. Have a great weekend!

Raoul Pal – CEO, Founder - Global Macro Investor

Julien Bittel – Head of Macro Research - Global Macro Investor

Insightful as always! Remind me, what makes up the GMI Financial Conditions Index?

Figuring out what went wrong from 2001-2009 only takes two charts—global oil production and American natural gas production. So that period was a commodity super cycle and production of the two most important commodities plateaued.