In this week’s newsletter, we’re going to run through the top five market charts on our radar...

As ever, much fuller and more in-depth analysis can be found in Global Macro Investor and Real Vision Pro Macro. Global Macro Investor is our full institutional research service and Real Vision Pro Macro is the sophisticated retail investor service, which is co-authored with leading research firm MI2 Partners.

Let’s dive right in...

GMI Chart 1 – US Equity Put/Call Ratio

A few weeks ago – in our GMI Weekly publication – we mentioned that equity markets were looking a tad overbought and that we were expecting some sideways chop and possibly a pullback soon.

Fast forward to today and the bears are back in town; the bears are back in town...

The US Equity Put/Call Ratio is back above +2 standard deviations for the first time since March of this year, and before that December of 2022. Only eleven times since 2012 have we been at these levels.

Historically speaking, this has worked well as a contrarian buy signal for equities...

GMI Chart 2 – S&P 500

The DeMark 13 sell signal that we highlighted back then has also worked well and we’re currently in the process of working through a new DeMark downside Sequential Countdown on day 4 of 13. We are however, rapidly approaching a confluence of important support levels of around 5% lower from here...

GMI Chart 3 – iShares MSCI ACWI ETF (Global Equities)

Global equities are also just in the process of retesting previous resistance (now support) following the breakout from the massive inverse head-and-shoulders pattern back in June.

In our view, this price action is not bearish (yet) and simply a technical correction following very overbought sentiment during the last week of July; more on sentiment later...

GMI Chart 4 – Bitcoin

Bitcoin also came down over the week to retest key support levels at around 25,200. We just triggered a new DeMark daily 9 setup today. These have worked well in the past in signaling a reversal in price. Additionally, with a current RSI of 20 (yes, 20!), Bitcoin is the most oversold since June of last year...

GMI Chart 5 – Ethereum

ETH is also the most oversold in RSI terms since June of last year and – if anything – looks to have formed a large bull flag pattern (bullish) ...

The GMI Big Picture

It’s perfectly normal for stocks to be taking a breather here. The NASDAQ has been front running the liquidity cycle all year and had already priced in an additional $800bn in Fed liquidity above current levels. We saw something very similar in 2019. Don’t forget, it’s equities job to discount the future.

Liquidity would suggest that fair value for the NASDAQ is currently closer to 12,500, but we expect Fed Net Liquidity to break higher soon and therefore think the NASDAQ will find support somewhere in the middle around 14,000...

Additionally, at this pace of sell-off, we’ll be back to oversold conditions for S&P 500 either this week or next...

Equity markets never go up (or down) in a straight line and, while we have been expecting a correction to take place over the summer months, we also continue to be of the view that the worst is behind us and that equities are following a fairly typical post-slowdown recovery pattern (i.e., choppy at times but ultimately a slow grind higher) ...

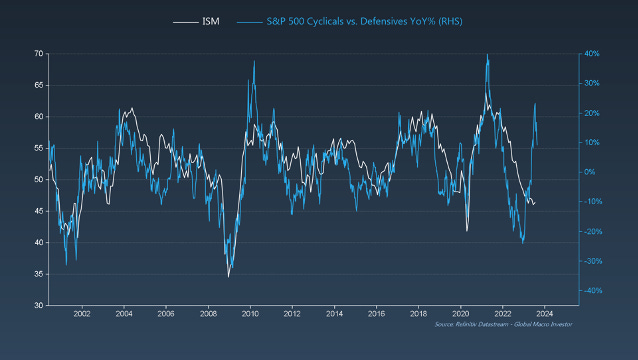

Remember, US Cyclicals vs. Defensives already priced in an ISM of 40 in October last year...

Finally, remember our hugely non-consensus call in Q4 of last year for a sharp rise in growth momentum in 2023 based on our lead indicators turning up, which has also been driving our more bullish stance on risk assets? Bingo! Philly Fed data for the month of August was released last week and EXPLODED higher...

All said, we think that while in the short-term there’s potential for more downside as markets realign with liquidity conditions and unwind the overbought sentiment, it’s going to be very difficult for this to be anything more than just a short-term correction.

Remember, retail money has been long this year but the pros (i.e. big banks) have not and they will very likely use this correction in equities to cover their deeply underwater shorts and get long.

This should provide a floor as to how far equities can fall and we think we can already get there in the next week or two as September seasonality starts to improve. Let’s see...

Good luck out there. That’s it from us this week.

Remember, this is just a small fraction of the work we do at GMI...

We cover the biggest secular themes in macro, crypto and technology within a full business cycle framework, which includes our comprehensive GMI asset allocation model as well as our GMI model portfolio offering an unrivaled, fully-recorded performance going back nineteen years.

You can find the story of GMI here: The Story of Global Macro Investor

If you would like to receive full, ongoing, detailed access to our work at Global Macro Investor (GMI) then you can apply here Global Macro Investor (GMI) or, if that is out of your price range ($18,000+), then a membership to the Real Vision Pro Macro Research Service may fit perfectly.

Enjoy.

Raoul Pal – CEO, Founder - Global Macro Investor

Julien Bittel – Head of Macro Research - Global Macro Investor

Fed net liquidity withdrawal continues to have a dampening impact on BTC

Great work from you and Julian again, I might upgrade from RV Plus to RV Pro macro soon. Cheers Peter

(Australia)