In this week’s newsletter, we’re going to run through the top 5 market charts on our radar right now.

As ever, much fuller and more in-depth analysis can be found in Global Macro Investor and Real Vision Pro Macro. Global Macro Investor is our full institutional research service and Real Vision Pro Macro is the sophisticated retail investor service, which is co-authored with leading research firm MI2 Partners.

Let’s dive right in...

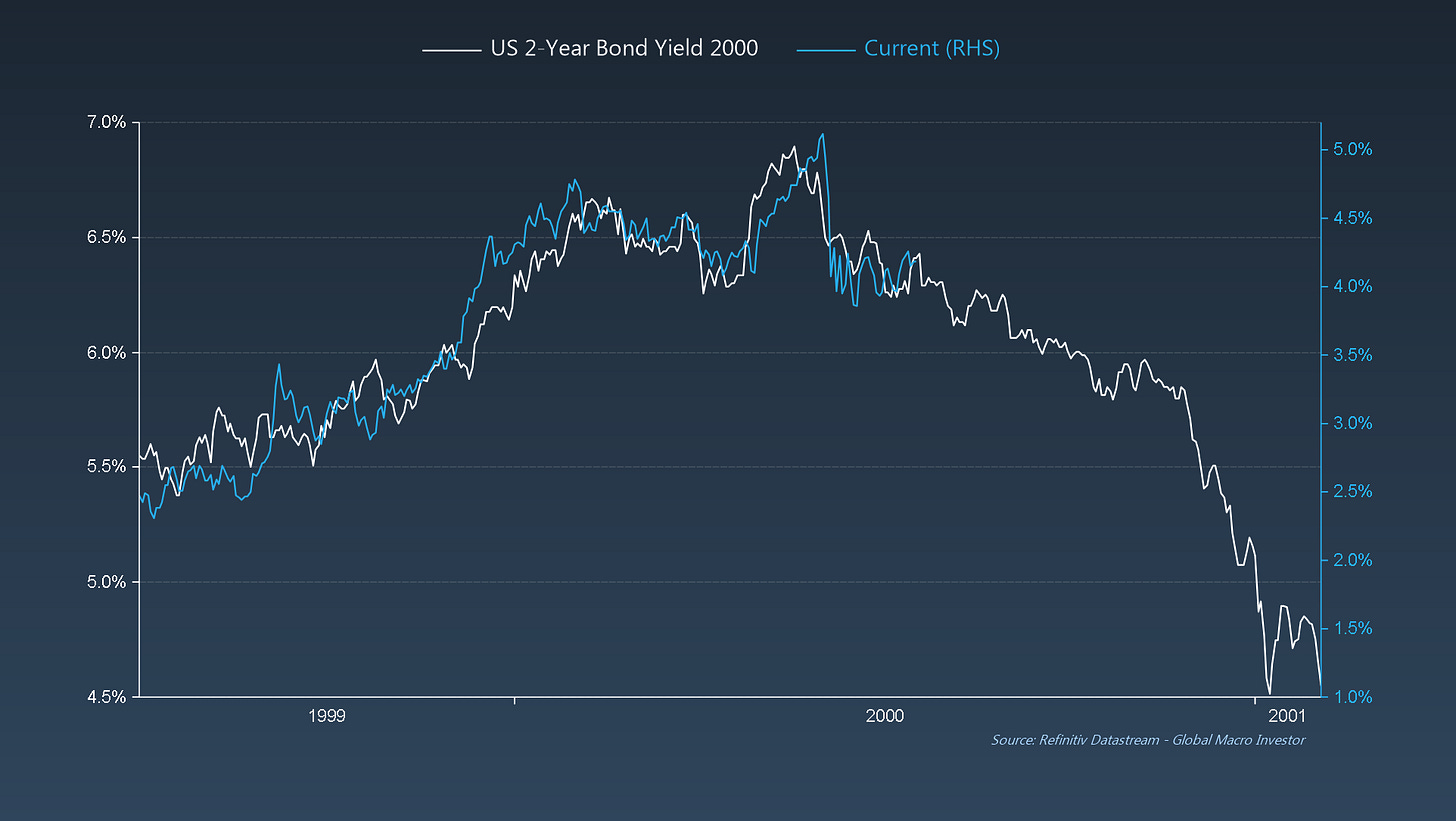

GMI Chart 1 – Bond Yields

US 2-Year Bond Yields seem to be following a similar pattern as in 2000...

... the 10-Year is also tracking this period closely...

... and when you consider that the aggregate speculative short position in US Treasuries just reached the most extreme level on record as a percentage of total open interest, the bond bull thesis is, in our opinion, becoming stronger by the day...

Additionally, DeMark daily 9 Setups have recently been quite successful in identifying inflection points on 10-year yields, and a new one was triggered on Thursday – something to keep an eye on...

GMI Chart 2 – Carbon Allowances

Carbon is still messing around ahead of a larger break higher... eventually. If we break above 102 the targeted move is 133, roughly 50% higher from current levels. Definitely another one to watch...

GMI Chart 3 – US Regional Banks (KRE)

The chart of the US Regional Banks (KRE) is not bullish... it still feels like consolidation before a break lower...

GMI Chart 4 – DXY

The DXY looks to be forming a big head-and-shoulders top. A break of 101 will lead to significant downside (but all within a secular dollar bull market). This should give risk assets a tailwind...

GMI Chart 5 – Global Equities

Global equities just look like the mirror image of the DXY and appear to be forming a large head-and-shoulders bottom. Again, all eyes on a potential DXY breakdown of 101. That’s the signal to watch for and will probably suggest equities head much higher from here...

We’ll also throw in this chart on ETH that, as we’ve been flagging for quite some time, continues to trade a lot like bitcoin during the 2014-2016 period...

The final two charts we'll leave you to mull over deal with positioning. At -7% of total open interest, speculative short positioning for the S&P 500 has just reached its highest level since August 2011...

Also, according to the April BofA Fund Manager Survey, everyone is still SUPER bearish despite the slow grind higher in equities as we continue to climb the “wall of worry”.

Looking at the data, the pain trade is clearly still higher, not lower...

No update from us next week as we’ll be writing our monthly GMI report but we have something special to share with you from our most recent report.

Enjoy!

Raoul Pal – CEO, Founder - Global Macro Investor

Julien Bittel – Head of Macro Research - Global Macro Investor

I look forward to these charts every week. Great stuff.

Good stuff.