The GMI Top 5 Weekly Charts That Make You Go Hmmm...

In this week’s newsletter, we’re going to run through the top five macro charts that are on our mind...

As ever, much fuller and more in-depth analysis can be found in Global Macro Investor and Real Vision Pro Macro. Global Macro Investor is our full institutional research service and Real Vision Pro Macro is the sophisticated retail investor service, which is co-authored with leading research firm MI2 Partners.

Let’s dive right in...

GMI Chart 1 – ISM vs. ISM New Orders

Last week, the ISM data for July came in. It was a bit of a mixed bag with the headline ISM number remaining low and both New Export Orders and Employment still firmly below 50. The most upbeat part of the report (and arguably the most forward-looking component of the ISM) was the fact that New Orders jumped nearly two full points to 47.3, leading the ISM by approximately one month...

GMI Chart 2 – ISM vs. ISM New Orders Minus Inventories

Also, ISM New Orders Minus Inventories, which leads the ISM by three months, continues to suggest that the ISM will bottom over the next couple of months...

GMI Chart 3 – ISM vs. GMI Financial Conditions Index

And this is what our primary tool for forecasting the economic cycle – the GMI FCI – has been telling us to expect all year long: a bottom in growth momentum, which is what equities have (correctly so) been pricing in all year long...

GMI Chart 4 – ISM YoY vs. GMI ISM Momentum Index

In terms of some of our ISM year-on-year leads, they indicate that the ISM will be back above 50 by January of next year...

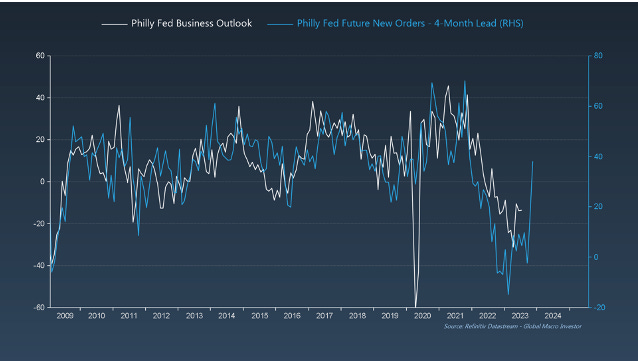

GMI Chart 5 – Philly Fed Business Outlook vs. Philly Fed Future New Orders

Prior to every ISM report we always get the Philly Fed data for the same month (so July); this month it showed a surge in the six-month outlook for New Orders. So, here’s what’s really going on: just like the relatively muted headline ISM number for July at 46.4, the headline Philly Fed number also remains low, and this means that current conditions are weak. However, the six-month outlook for New Orders has EXPLODED higher and this component is leading and means that expectations are improving...

The GMI Big Picture

So far, our The Everything Code thesis is playing out according to plan and suggests that we’re still in the early stages of a new economic cycle and that growth momentum will continue to rise into Q1 2025 when we expect growth momentum to start to top out and begin to roll over...

Also, we wrote extensively on the topic of inflation in our August GMI Monthly and why we are not expecting rising commodity prices to impact the Headline CPI numbers until early next year. However, based on where we are in the cycle and the ongoing recovery in lead indicators, commodities should now begin to do well, and our GMI FCI forecasts commodity prices will rise to around 20% YoY by May 2024...

The improvement in growth and a weaker dollar environment – both of which we’ve been expecting and very vocal on all year long – is also what’s been supporting things like Emerging Market Equities: a pure play on stronger growth and a weaker dollar...

Just to conclude, what’s important to understand is that at GMI we’re forced to live around nine months in the future versus the current ISM, which is why we managed to be right on equities this year off the lows back in October. It’s our job to try and figure out where risk assets will trend ahead of the usual discount window versus ISM – which tends to be around three months – and why the GMI Business Cycle Dominoes framework is so helpful. The next domino to fall? Employment. THIS is what the Fed will be hyper focused on in H2 order to give them the cover to stimulate later in Q4 – MOAR COWBELL...

That’s it from us this week. It’s been a data heavy week with lots of conflicting narratives floating around. Hopefully sharing our take on a couple of core data points helps you separate some of the signal from the noise in your investment process...

Enjoy!

Raoul Pal – CEO, Founder - Global Macro Investor

Julien Bittel – Head of Macro Research - Global Macro Investor

Very helpful as RV always is. Thanks.

Thanks!