This is How the World Works

This is How the World Works

I’m going to tell you the story of how the world works from a very big-picture point of view. Set aside any preconceived notions you may have and join me on this journey. Once you see it, you can’t unsee it and it will frame everything for you.

The Magic Formula

Long-term GDP growth = population growth + productivity growth

This simple formula explains everything we need to know about how the world works.

Let’s break it down. For the purposes of this piece, I’ll be using the US as the main example, but keep in mind that it also applies to other developed countries (plus China) as they are all very similar (albeit generally older).

Ok, here we go… You’ll find that this magic formula works across the entire globe and is actually one of the key reasons for war as well. Think about it… generally speaking, wars are fought to either increase the population (think the conquering of India for example) or to increase resources in order to lower input costs for productivity growth (oil wars).

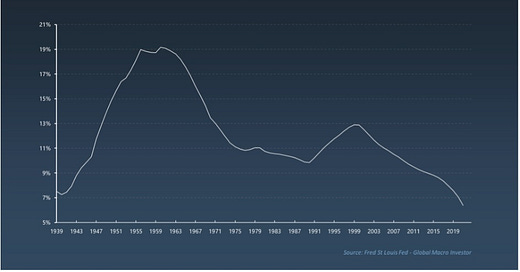

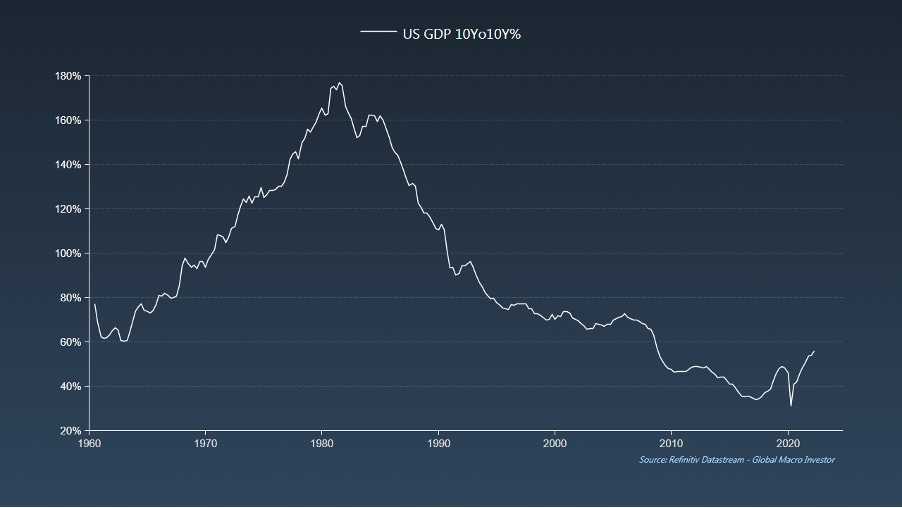

As I’ve explained in previous articles, US population growth has been falling for decades now…

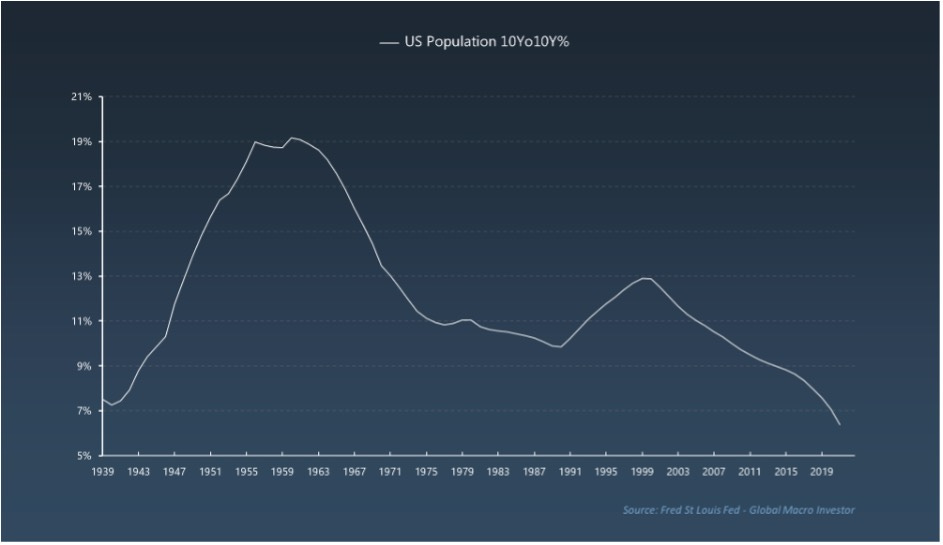

... and productivity growth has collapsed since the 1960s…

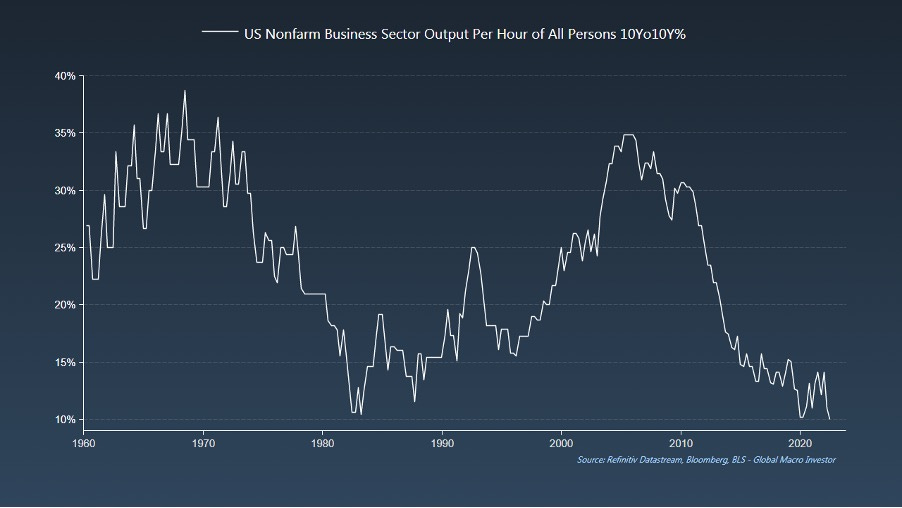

What happens when both population and productivity growth fall in conjunction? Long-term trend rate GDP falls. Simple...

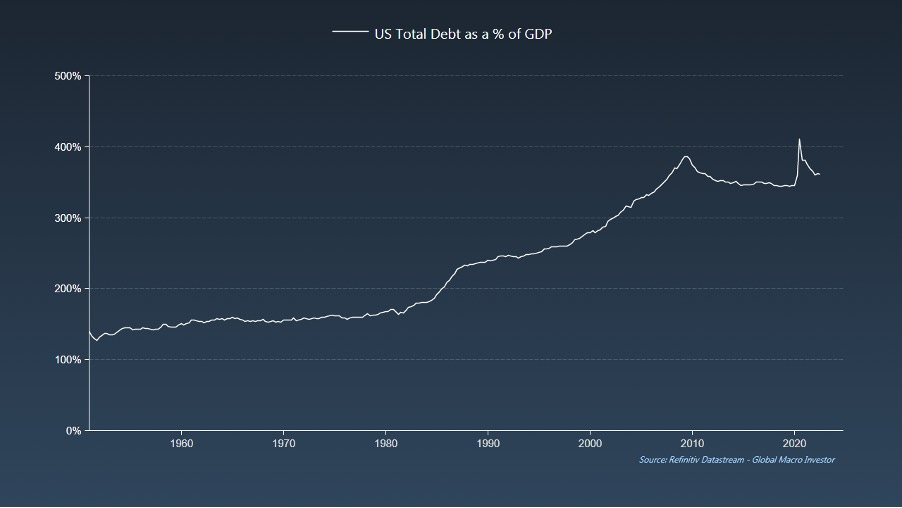

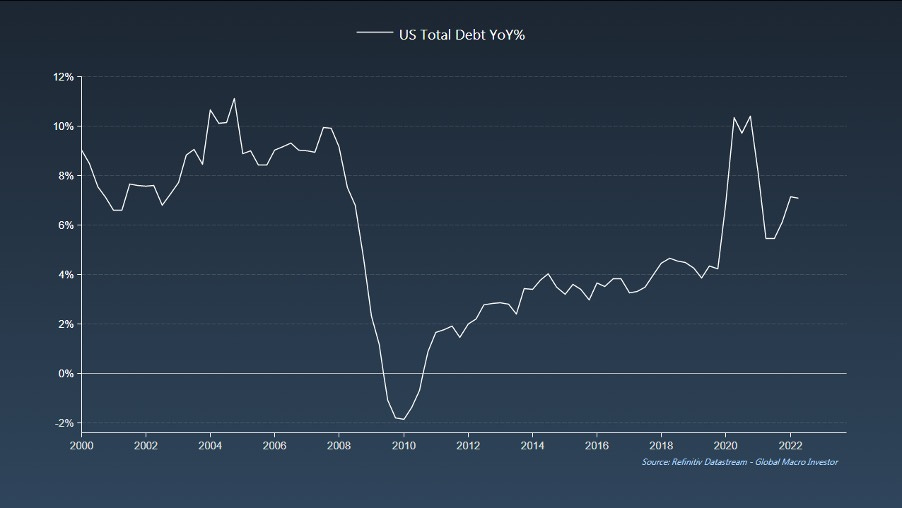

So, how do you resolve the problem of falling GDP stemming from population growth and productivity? Grow the debt…

In an attempt to offset the fall in GDP growth, debt has exploded, which as just discussed, is driven by productivity and demographics.

However, GDP is the income that is used to pay off the debt + interest. In so many words, GDP NEEDS to grow in order to pay off or service the debt.

There’s a problem though…

Demographics shape the destiny of nations and consequently, their politics.

The reality is that you cannot grow GDP via demographics without another baby boom, but that isn’t going to happen due to several factors: A) The rise in technology. B) Higher life expectancy. And finally, C), the enormous debt burden. Historically, there has been another solution for falling population growth: immigration. However, with jobs and real wages under pressure from technology, it is politically unacceptable.

Productivity is, well, not very productive…

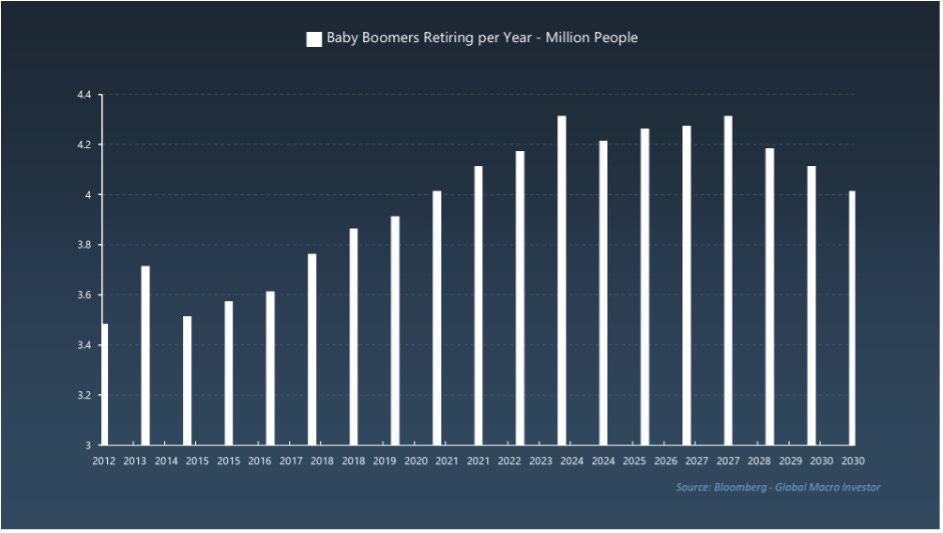

Therefore, productivity needs to increase and that can’t happen until the baby boomers die off.

You see, they key issue here is that retirees are non-productive.

The 65+ year old cohort makes up 40% of the population over the working age of 18, and accounts for 22% of the total population; and the retirees keep coming…

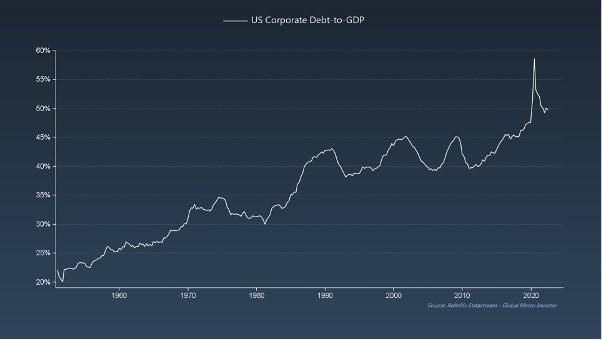

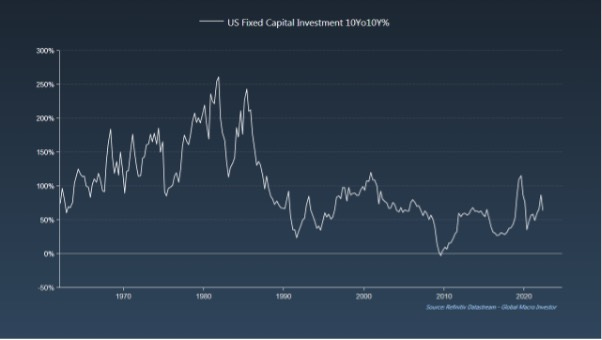

There was a time when productivity issues were solved by fixed capital investment. That time has come and gone. The corporate sector is 50% of GDP in debt and nowadays prefers share buybacks to FCI…

Take a look at how, since 1980, FCI growth absolutely collapsed as debt burdens rose…

Robots to the rescue!

Not so fast… While robots and AI are likely to play a massive role in increasing productivity, the truth is we are still at least a decade away from that happening at scale. In the meantime, we still have to overcome the immediate cliff of the baby boomer population retiring and then eventually shrinking…

So, how do the powers that be resolve the issue we all face?

Prime the fiscal pumps…

Fiscal stimulus is a tool that can be used to inflate GDP for short periods of time. Currently it is being used to avoid defaulting on the debt (i.e., to maintain income). This becomes obvious when you observe the rise of Direct Transfer Payments, the latest monetary tool to be deployed.

The issue with fiscal stimulus in a high debt world is that it INCREASES the debt to GDP. Think of it like this: GDP is not growing fast enough to generate tax revenues. So, stimulus keeps increasing debts. Have you ever wondered why governments around the world just keep adding to their debt piles instead of reducing them?GDP growth is simply NOT high enough.

Is more debt the answer then?

In the interim, that appears to be the only option.

However, the game of debt growth to drive GDP growth is nearing its inevitable end.

The average rate of GDP growth since 2008 is 1.7% but debt growth is 6%. What does this mean? It now takes three units of debt to make one unit of GDP…

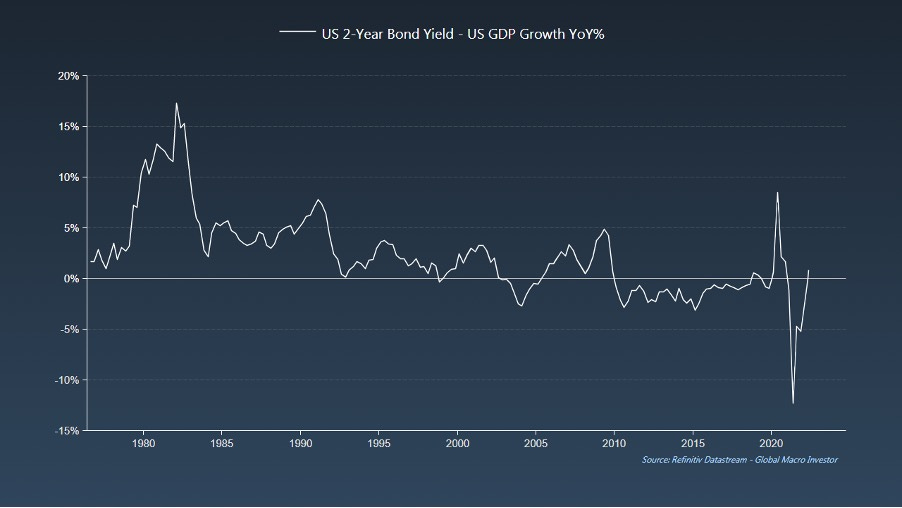

What about negative real rates? How do they factor in?

In order to take on even more debt, or continue to service existing debts, we require either the debt burden to go down, or interest rates to be lower than GDP growth (basically negative real rates at the economy level).

Since the debt bubble blew up, rates have had to be lower than GDP growth to allow debts to be serviced (remember, GDP is the income side of the balance sheet) …

If we look at the more traditional method of 5-year breakeven inflation rates versus 5-year yields, we can see that the trend fair value of real rates is -1%; in other words, we are currently WAY TOO HIGH for the system to take this for much longer. In fact, we are over 3 standard deviations from trend…

Keep in mind that every time real rates go positive, the government is forced to fill the revenue/income hole to service the debt via fiscal stimulus. If they fail to do so, the debt doesn’t get paid, and the system fails… or the central bank needs to drive down real rates to negative levels again.

The fact of the matter is that positive real rates bankrupt the system… and fast.

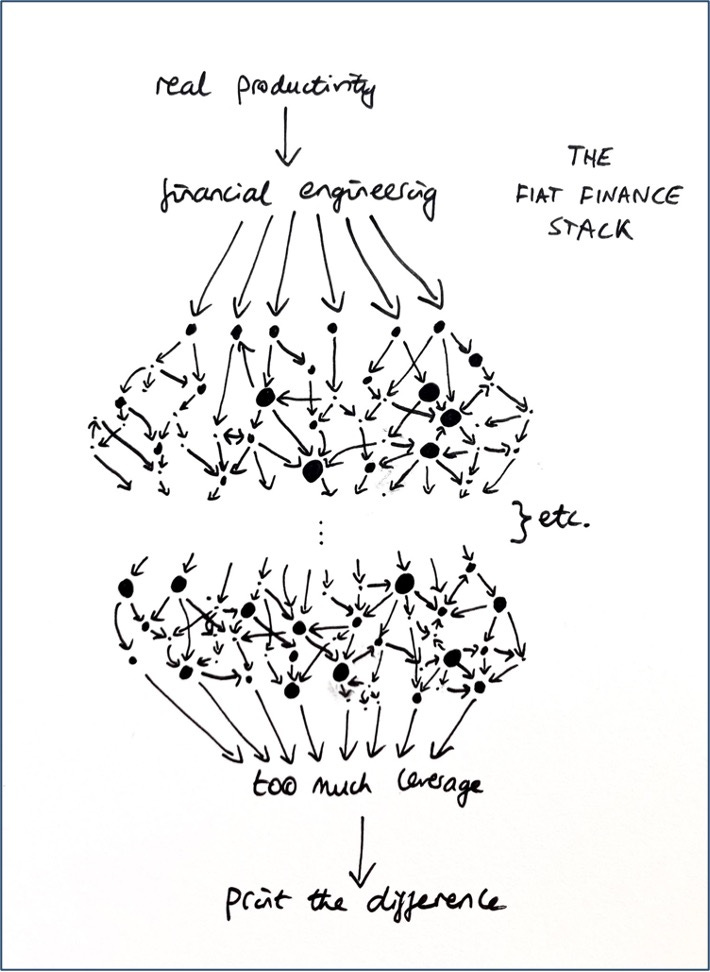

Now, let’s look at rising asset prices…

The debt burden can be reduced by asset prices rising which would lower the debt coverage ratio. It’s important to note that pensions need also to be considered in this equation as they are liabilities at a future date. Pensions need asset prices to go up.

The whole indebted system needs asset prices to rise faster than debt service costs. If this does not happen, the economic balance sheet collapses and debts become unserviceable; the debt goes into default and/or the collateral is margin called.

Consider the following:

· If the governments need to fiscally stimulate in times of positive real rates to keep the balance sheet intact for the entire financial system (households, corporates and government), then the only answer is to print money to buy the debt in times of excess stimulus and low GDP growth (recession).

· If the government and central bank need asset prices to rise faster than debt growth in order to stop the economic balance sheet implosion, then the only way to do that is to debase the currency to lower the denominator, to give asset prices the illusion of rising.

Given the reality that the world finds itself in today, the only option is debt monetisation every time GDP falls, or assets fall by any significant amount.

This is the debt trap. Nothing can be allowed to go wrong... or it ALL goes wrong.

Once you understand this, then everything makes sense. This is how the world works...

As ever, a much fuller and more in-depth analysis can be found in Global Macro Investor (www.globalmacroinvestor.com) and Real Vision Pro Macro (https://www.realvision.com/pricing).

Global Macro Investor is our full institutional research service and Real Vision Pro Macro is the sophisticated retail investor service, which is co-authored with leading research firm MI2 Partners.

Raoul Pal – CEO, Founder – Global Macro Investor

Julien Bittel – Head of Macro Research, Global Macro Investor